Investor Series Part 6: Profit Eating Pitfalls

One of the first things I tell a potential Investor Builder is that we want them to be successful. If they are profitable (and have fun doing it!), they’re a lot more likely to come back to NDI to build another home. This is why many of our Investors build with us over and over again. I also tell them that I am pretty opinionated. I try to give our Investor Builders sound advice based on our experience building in northern Virginia – what house type would work best, what options (if any) they should add in order to maximize their investment, etc. Some take it and some leave it, and that’s all fine.

But I hate to see Investors make a common mistake (we want maximum success!). If you’re considering building on spec, here are some common mistakes and my tips on how to avoid these profit eating pitfalls…

Paying Too Much For The Lot

This is a big one because what you pay for the lot dictates what you will make. Why? Because there comes a point that you can’t build enough house to compensate for an overpriced lot. Buying a spec lot is exciting but what isn’t exciting is doing everything right during the project but because you paid too much for the lot, your profit isn’t where it needs to be.

Jen’s Tip: Consult with a local (experienced) realtor and get a good sense for the comparable sales in the neighborhood. Not only what “lots” or tear downs have sold but also what new homes have sold for in your area. I always throw out the lowest and highest comps and look in the middle. Buying a lot is the first step in building a spec. Be smart about it because it can make or break your entire project.

Hanging Your Hat On The Highest Comp

I’ve worked with a number of Investors over the years who look at one comp and base the entire project on the one (GREAT) comp. It never fails that when the Investor goes to list their new home (based on the one high comp), it ends up sitting on the market.

Jen’s Tip: You must run the project numbers ahead of time! Determining an exit price 6-8 months out can be daunting. Always go conservative. This is why I throw out the highest and lowest comps and look in the middle (I typically go lower than middle just to be safe). Do the numbers work? I do this calculation every time I sit down with an investor.

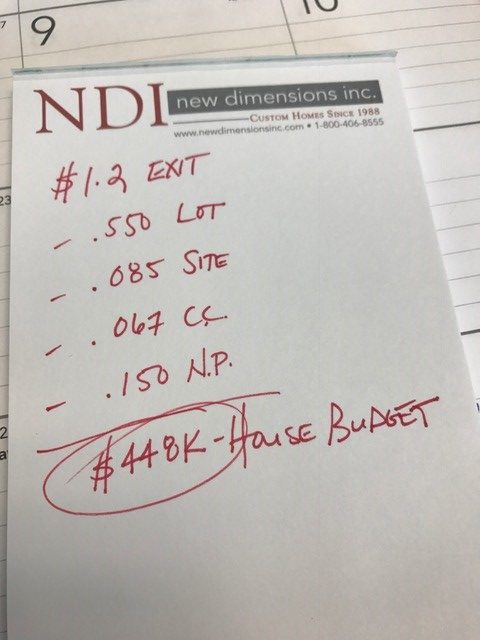

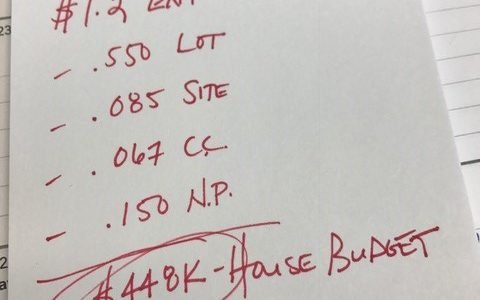

Exit Price – Lot Cost – Site Cost Estimate – Carry Cost (finance & closing fees) – Net Profit = House Budget

Here’s one I just did today…

The Investor wants to make a minimum of $150K on this project. Most of the new homes in the neighborhood are selling for $1.3 million and up. In fact, there is nothing new at $1.2 million. You know what that means? If a buyer’s budget is only $1.2 million, they don’t have anything to choose from…until now.

And don’t get greedy. I had an Investor tell me before the project started that he would be happy to sell the new home for $930K. When he went to list it, he listed for $1.1 million. The house sat for months. He ended up selling it for over $930K but he paid a lot more in carry costs than originally budgeted.

Don’t Over Build (or under build!)

I cannot stress this enough – most buyer’s won’t care about the custom changes an Investor decides to make in the house. KISS – Keep It Simple Silly (edited – HA!). If the area you’re building dictates certain finishes, add them but don’t get carried away as you might in a home you are building for yourself.

Jen’s Tip: Remove the emotion. Build for the broader market (not everyone loves your favorite color!). We can advise you on what finishes will sell. We do this all the time, and I think we’re pretty darn good at it. As long as you choose to listen to what we have to say…

Dream Big. Build Smart.